Introduction

Retirement is a significant life milestone that requires careful planning and consideration, and understanding the retirement age is a crucial aspect of this process. In the United States and Canada, the retirement landscape is dynamic and influenced by various factors. In this comprehensive guide, we’ll explore the retirement age in both countries, offering valuable insights for beginners to navigate the complexities of retirement planning.

A Comprehensive Guide for Beginners

Retirement Age Basics

1. Defining Retirement Age

Retirement age refers to the age at which individuals can begin receiving full retirement benefits from government-sponsored programs, such as Social Security in the United States and the Canada Pension Plan (CPP) in Canada. Understanding when you can access these benefits is vital for effective retirement planning.

2. Social Security in the USA

In the USA, Social Security is a cornerstone of retirement income. Full retirement age (FRA) for Social Security benefits varies based on the year of birth. It is essential for beginners to know their FRA to optimize their Social Security benefits.

3. The Canada Pension Plan (CPP)

Canada, on the other hand, has the CPP, which provides retirement benefits. The standard age to receive the full CPP pension is 65, but individuals can choose to take a reduced pension as early as age 60 or delay it until age 70.

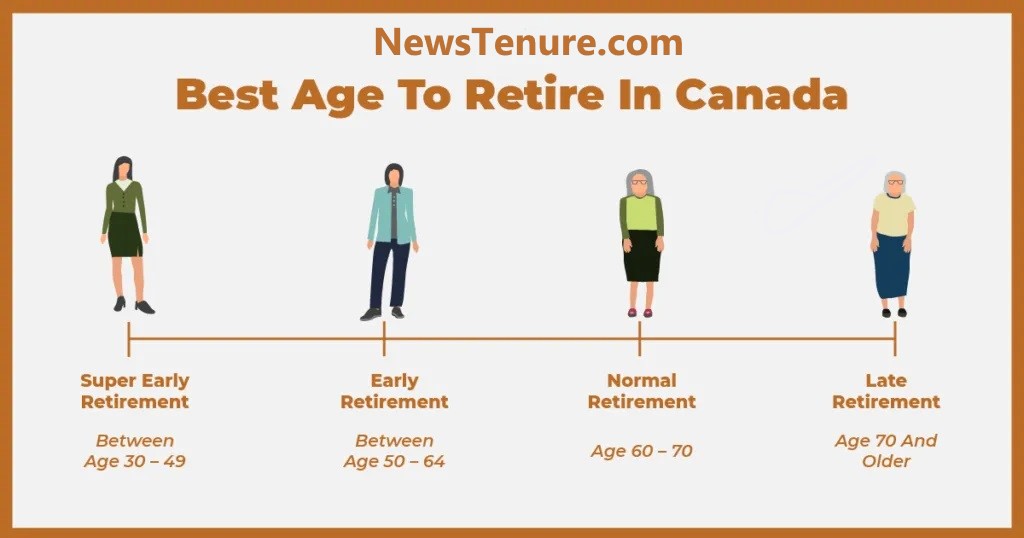

Retirement Age Variations

1. Early Retirement

Many individuals opt for early retirement, but it comes with a trade-off. In both countries, taking early retirement results in reduced benefits. Understanding the implications of early retirement is crucial for making informed decisions.

2. Delayed Retirement

Delaying retirement can be financially advantageous. Both the USA and Canada offer incentives for delaying Social Security and CPP benefits, respectively. Beginners should explore these options to maximize their retirement income.

Factors Influencing Retirement Age

1. Health Considerations

Health is a significant factor in determining when to retire. Understanding your health needs and potential healthcare costs is vital for planning a comfortable retirement.

2. Financial Preparedness

Financial readiness is paramount. Beginners should assess their savings, investments, and other income sources to ensure they can sustain their desired lifestyle throughout retirement.

3. Employer Pension Plans

For those with employer-sponsored pension plans, it’s essential to comprehend how these plans integrate with government benefits and influence the overall retirement age decision.

Navigating Retirement Age in the USA

1. Social Security FRA

In the USA, the Social Security full retirement age ranges from 65 to 67, depending on the year of birth. Understanding this benchmark is fundamental for maximizing Social Security benefits.

2. Early and Delayed Retirement Strategies

Exploring strategies for early or delayed retirement in the USA is crucial. Beginners should be aware of the financial implications and strategies to optimize their retirement income.

3. Medicare Eligibility

Healthcare is a significant aspect of retirement. Beginners should understand Medicare eligibility, which typically begins at age 65, to ensure adequate health coverage during retirement.

Navigating Retirement Age in Canada

1. CPP Full Pension Age

In Canada, the standard age for receiving the full CPP pension is 65. However, individuals can choose to receive a reduced pension as early as age 60 or delay it until age 70. Beginners should weigh the pros and cons of these options.

2. Old Age Security (OAS) Benefits

Canada also provides Old Age Security benefits, which have their own eligibility criteria. Beginners should be aware of the OAS benefits and how they complement the CPP.

3. Healthcare Considerations

Similar to the USA, healthcare considerations are crucial in Canada. Understanding the healthcare system and supplemental insurance options is vital for a secure retirement.

Comparative Analysis: USA vs. Canada

1. Social Security vs. CPP

A comparative analysis of Social Security and CPP benefits can help beginners understand the differences in structure, eligibility, and payout.

2. Tax Implications

Understanding the tax implications of retirement income in both countries is essential. Beginners should be aware of potential tax liabilities and explore strategies to minimize them.

Conclusion

In conclusion, understanding the retirement age in the USA and Canada is a foundational step for effective retirement planning. Beginners should grasp the basics of government-sponsored programs, weigh the factors influencing retirement age decisions, and navigate the nuances of early and delayed retirement. By doing so, individuals can embark on their retirement journey with confidence, knowing they have strategically planned for a financially secure and fulfilling post-career life.

FAQs

- What is the full retirement age for Social Security in the USA?

- The full retirement age for Social Security in the USA varies from 65 to 67, depending on the year of birth.

- Can I receive CPP benefits in Canada before the age of 65?

- Yes, individuals in Canada can choose to receive a reduced CPP pension as early as age 60.

- Are there penalties for early retirement in both the USA and Canada?

- Yes, taking early retirement typically results in reduced benefits in both countries.

- How does healthcare coverage work during retirement in the USA and Canada?

- In both countries, healthcare coverage is a crucial consideration. In the USA, Medicare eligibility begins at age 65, while in Canada, individuals rely on the public healthcare system, supplemented by optional insurance.

- What is the Old Age Security (OAS) benefit in Canada, and how does it differ from CPP?

- The OAS benefit is a separate program in Canada, providing a basic pension to individuals aged 65 and older. Unlike CPP, it is not based on contributions but is subject to income testing.